Top 30 Forex Brokers Fundamentals Explained

Top 30 Forex Brokers Fundamentals Explained

Blog Article

The Only Guide to Top 30 Forex Brokers

Table of ContentsTop 30 Forex Brokers Fundamentals ExplainedThe Single Strategy To Use For Top 30 Forex Brokers5 Easy Facts About Top 30 Forex Brokers ShownTop 30 Forex Brokers Can Be Fun For EveryoneThe Facts About Top 30 Forex Brokers UncoveredHow Top 30 Forex Brokers can Save You Time, Stress, and Money.Getting The Top 30 Forex Brokers To WorkThe Basic Principles Of Top 30 Forex Brokers

Each bar chart stands for one day of trading and contains the opening cost, greatest cost, lowest cost, and shutting price (OHLC) for a profession. A dashboard on the left stands for the day's opening rate, and a comparable one on the right represents the closing price.Bar graphes for money trading aid investors determine whether it is a purchaser's or vendor's market. The upper section of a candle light is made use of for the opening cost and greatest cost factor of a money, while the reduced portion shows the closing rate and least expensive rate point.

The Best Guide To Top 30 Forex Brokers

The developments and shapes in candle holder charts are used to recognize market direction and movement.

Financial institutions, brokers, and dealers in the forex markets allow a high quantity of utilize, suggesting investors can control big placements with reasonably little cash. Take advantage of in the range of 50:1 is common in forex, though even greater quantities of take advantage of are offered from certain brokers. Nonetheless, utilize should be made use of very carefully since numerous unskilled traders have suffered substantial losses utilizing more utilize than was required or prudent.

Top 30 Forex Brokers Things To Know Before You Buy

A currency trader needs to have a big-picture understanding of the economies of the numerous countries and their interconnectedness to realize the principles that drive currency worths. The decentralized nature of foreign exchange markets suggests it is much less controlled than various other financial markets. The degree and nature of law in foreign exchange markets depend upon the trading jurisdiction.

Foreign exchange markets are amongst the most liquid markets in the world. So, they can be much less unstable than other markets, such as realty. The volatility of a certain currency is a feature of numerous aspects, such as the national politics and business economics of its country. Events like economic instability in the form of a settlement default or imbalance in trading partnerships with another currency can result in substantial volatility.

The smart Trick of Top 30 Forex Brokers That Nobody is Talking About

The Financial Conduct Authority (https://slides.com/top30forexbs) (FCA) monitors and controls foreign exchange professions in the UK. Money with high liquidity have a ready market and show smooth and predictable price action in action to exterior events. The U.S. buck is the most traded money in the globe. It is paired in 6 of the marketplace's 7 most fluid currency sets.

Indicators on Top 30 Forex Brokers You Should Know

In today's info superhighway the Foreign exchange market is no longer entirely for the institutional investor. The last 10 years have actually seen an increase in non-institutional traders accessing the Forex market and the advantages it provides.

:max_bytes(150000):strip_icc()/foreign-exchange-markets.asp-final-16abed069d5e4ba0924142476dec4211.png)

The Of Top 30 Forex Brokers

Forex trading (foreign exchange trading) is a worldwide market for dealing money. At $6. 6 trillion, it is 25 times bigger than all the world's stock exchange. Forex trading determines the exchange rates for all flexible-rate money. Therefore, rates transform constantly for the money that Americans are most likely to use.

When you sell your money, you receive the this hyperlink payment in a different money. Every vacationer who has gotten international currency has actually done forex trading. The investor acquires a certain currency at the buy rate from the market maker and sells a various money at the selling price.

This is the deal expense to the trader, which consequently is the profit made by the market maker. You paid this spread without understanding it when you exchanged your bucks for international money. You would certainly observe it if you made the purchase, terminated your trip, and then attempted to exchange the money back to bucks right away.

The Basic Principles Of Top 30 Forex Brokers

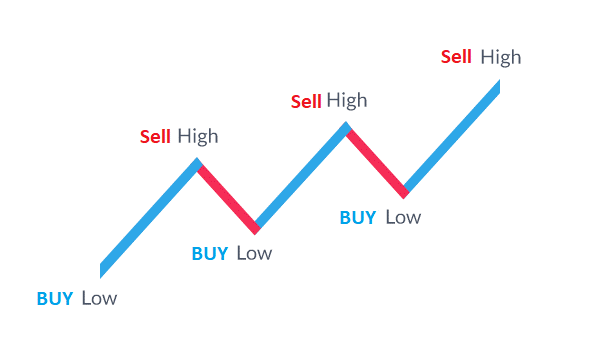

You do this when you believe the money's value will certainly drop in the future. Businesses short a money to protect themselves from risk. Yet shorting is very dangerous. If the currency rises in worth, you need to get it from the supplier at that cost. It has the exact same pros and disadvantages as short-selling supplies.

Report this page